RFM segmentation is a marketing technique that categorises customers based on their purchasing behaviour. The acronym “RFM” stands for Recency, Frequency, and Monetary value, which are the three dimensions used to evaluate customer activity:

Recency (R): This measures how recently a customer made a purchase. The idea is that customers who have bought something more recently are more likely to engage again compared to those who haven’t made a purchase in a while.

Frequency (F): This refers to how often a customer makes a purchase. Customers who buy more frequently are considered more loyal and valuable, as they engage with the brand regularly.

Monetary value (M): This looks at how much money a customer spends, typically within a specific period. High-spending customers are often seen as more valuable because they contribute more revenue.

How Does RFM Segmentation Work?

Data Collection: Gather data on each customer’s transaction history, focusing on recency, frequency, and monetary value.

Scoring: Assign scores to each customer for R, F, and M based on their behaviour. For example, customers might be scored on a scale of 1 to 5 for each category, with 5 being the best (most recent, most frequent, highest spending).

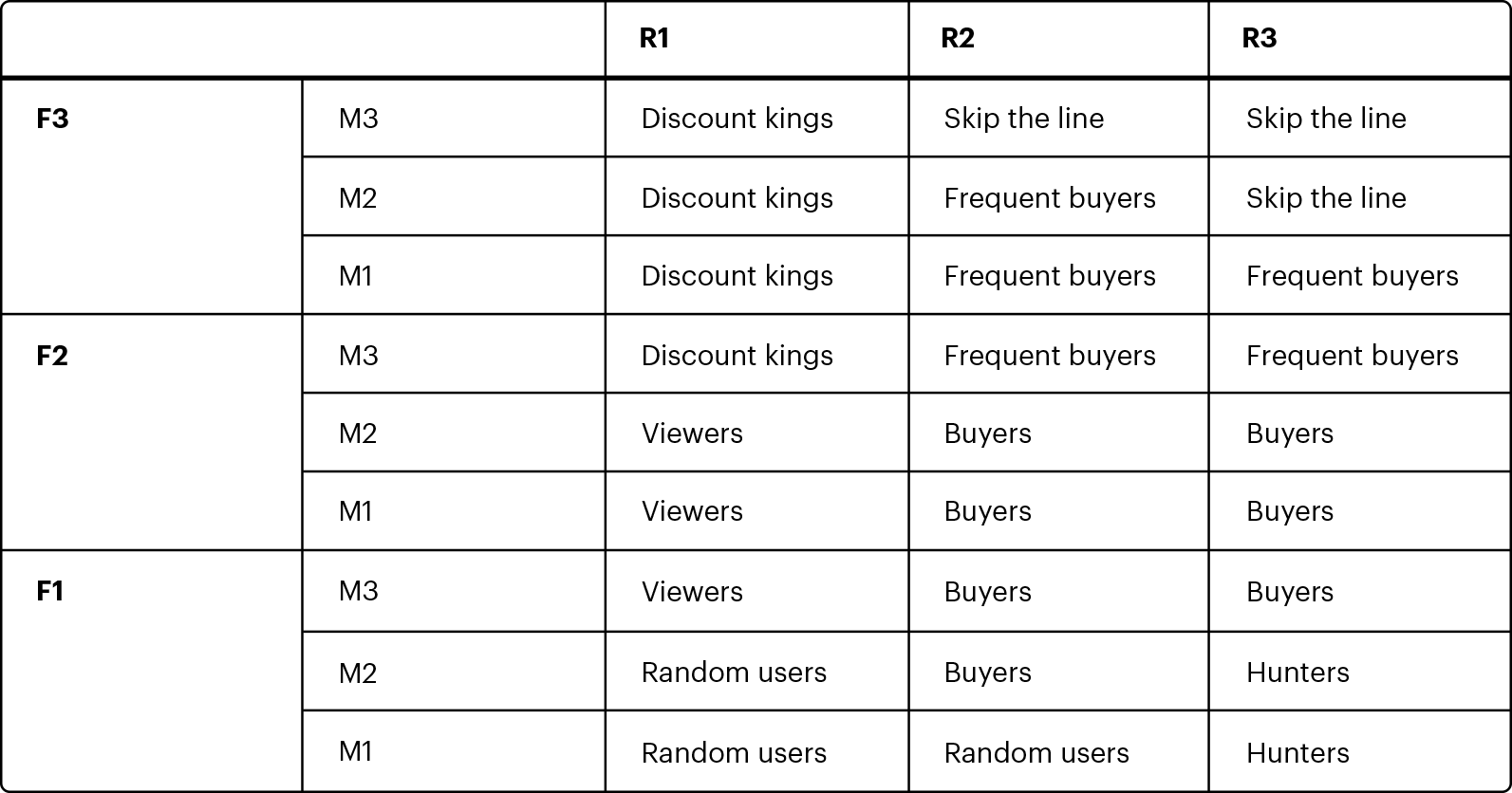

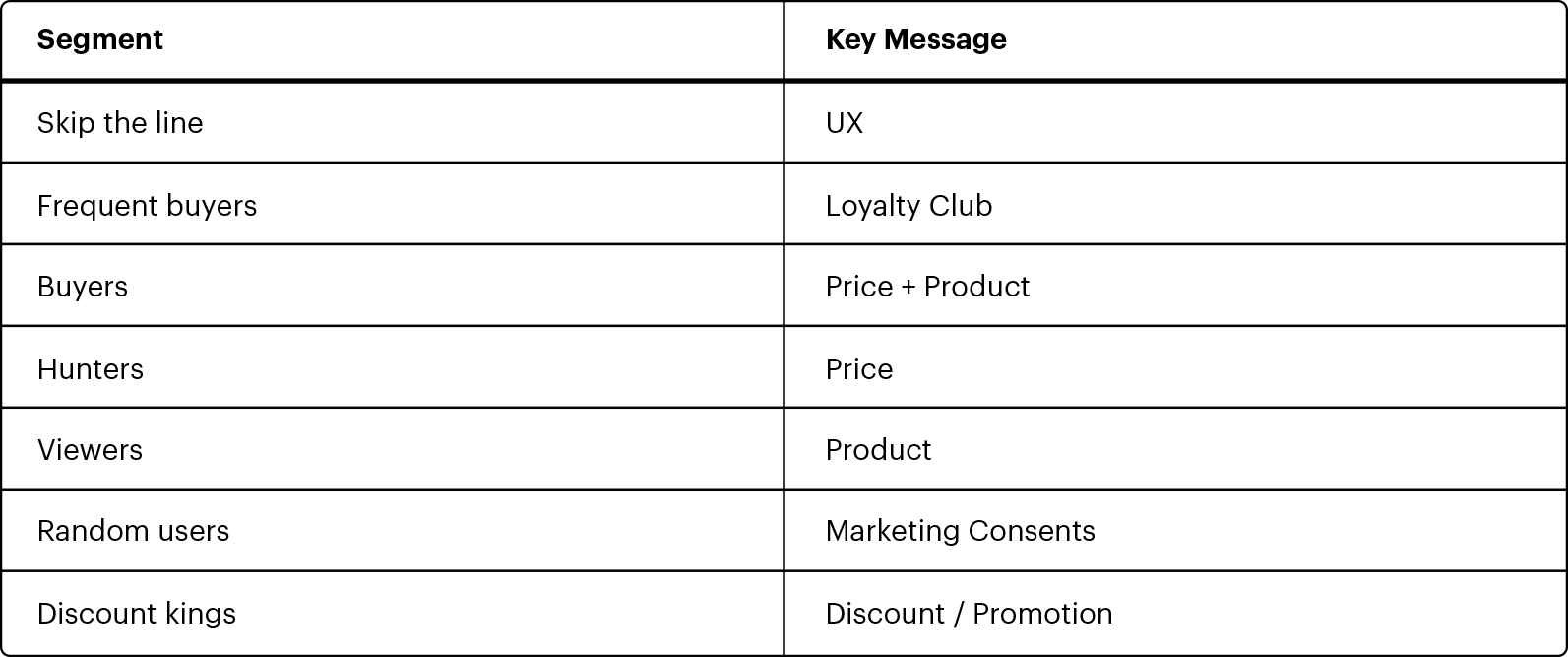

Segmentation: Combine the scores to create customer segments. For instance, a customer with high recency, high frequency, and high monetary value would be in a top-tier segment, while those with low scores might be in a lower-tier segment.

Static or dynamic segment thresholds?

In RFM (Recency, Frequency, Monetary) analysis, choosing between using STATIC or DYNAMIC segment thresholds significantly impacts how customers are categorized and how actionable insights are generated. Here's an overview of each approach:

Static segment thresholds that do not change over time. Once set, they are applied consistently across different periods.

How It Works: You define fixed cutoff points for Recency, Frequency, and Monetary values. For example:

- Recency: 0-30 days = High (5), 31-60 days = Medium (3), 61+ days = Low (1).

- Frequency: 10+ purchases = High (5), 5-9 purchases = Medium (3), 1-4 purchases = Low (1).

- Monetary: $1,000+ spent = High (5), $500-$999 = Medium (3), <$500 = Low (1).

Advantages:

- Consistency: Provides stable, comparable segments over time, making it easier to track performance and trends.

- Simplicity: Easier to implement and manage, particularly in organizations with limited analytical resources.

- Historical Comparison: Facilitates straightforward year-over-year or period-over-period comparisons.

Best for:

- Businesses with relatively stable customer behavior and longer planning cycles.

- Situations where historical trend analysis is crucial.

Dynamic segment thresholds adjust based on the current data distribution. This means the thresholds for defining segments can shift as customer behavior changes.

How It Works: Thresholds are recalculated periodically (e.g., monthly or quarterly) to reflect the latest customer data. For example:

- Recency: Instead of fixed days, the top 20% of most recent purchasers might be scored as High (5), the next 30% as Medium (3), and the rest as Low (1).

- Frequency: Adjusted based on the distribution of purchases, so the top 10% of frequent buyers are always classified as High (5), etc.

- Monetary: Calculated so that the highest spenders are always in the top tier, regardless of absolute spending.

Advantages:

- Flexibility: Responds to shifts in customer behavior, making segments more relevant and actionable.

- Improved Targeting: Helps in identifying and reacting to emerging trends, such as a sudden increase in low-frequency, high-value customers.

- Personalization: Enables more accurate and timely segmentation, which can enhance personalized marketing efforts.

Best for:

- Fast-paced industries where customer behavior is volatile.

- Businesses focused on real-time or short-term marketing optimization.

Which to Choose?

Static thresholds: Use if you need consistency over time and your customer base exhibits stable purchasing patterns. This approach is suitable for long-term strategic planning and simpler, more straightforward analysis.

Dynamic thresholds: Option for this if your market is dynamic and you require agility in customer segmentation. Dynamic boundaries are more appropriate when customer behavior changes frequently, and immediate responsiveness is crucial.

In some cases, businesses may benefit from a hybrid approach, using static boundaries for long-term trend analysis and dynamic boundaries for short-term, tactical decisions. The choice ultimately depends on your business needs, resources, and the nature of your customer interactions.

Yes, combining RFM segments using **business logic** is extremely useful in reducing the number of potential marketing scenarios and simplifying decision-making. While RFM can create a large number of segments, combining them strategically can help focus efforts on the most relevant customer groups and marketing actions. Here’s why and how it works:

Why Combining RFM Segments is Useful?

Avoid Over-Segmentation - Pure RFM analysis can result in too many segments (e.g., 125 segments, if using a 5x5x5 grid for Recency, Frequency, and Monetary). Managing personalized campaigns for each of these can be overwhelming and inefficient.

More Targeted Marketing - Not all combinations of RFM segments will require unique strategies. By applying business logic, you can group similar segments into broader categories that align with your marketing objectives. This allows you to focus on the key segments that offer the highest ROI or are most relevant to your goals.

Streamlined Marketing Scenarios - Combining RFM segments based on business rules helps to create more meaningful, actionable groups (e.g., “High Recency & High Monetary” might fall into the same strategy bucket as “High Recency & Medium Monetary”). This reduces complexity and ensures that marketing campaigns are more manageable.

Efficient Resource Allocation - Reducing the number of scenarios and customer segments allows for more focused use of marketing resources (budget, creative efforts, and customer communication), resulting in better optimization and higher effectiveness.

How to Combine RFM Segments With Business Logic?

Focus on Business Objectives. Use these goals to guide the combination of RFM segments. For example, a customer with high recency and frequency but low monetary value could be targeted for an upselling campaign as a 'Frequent Buyer.' Meanwhile, a customers with low recency but high monetary and frequency values could be considered a 'Discount King' and targeted with discount offers.

Create High-Level Groupings. For example, combine segments with high frequency and monetary value (regardless of recency) into one “Skip the line” group. They can be targeted for rewards programs, exclusive services, or enhanced return policy.

Reduce the Number of Scenarios by Overlapping Strategies. For instance, customers with both high frequency and monetary value might receive similar messaging, even if their recency scores differ slightly. This reduces the need for separate marketing scenarios.

Match the specific messages you want to convey to segments that represent the types of customers you define. For example: